8 mins

In order to understand Carbon Offsets we need to first understand the need of introducing Carbon offset. For an introductory idea you can refer to our other blog on ‘Carbon footprint’.

Now in order to reduce the Carbon footprint, ‘carbon offset’ has been coined against which individuals, corporates, and governments are given financial instruments in the form of ‘carbon offset credits’ which further can be used as a currency while financing a project.

This inclusion of financial aspect has largely motivated all the stakeholders to reduce their carbon footprint.

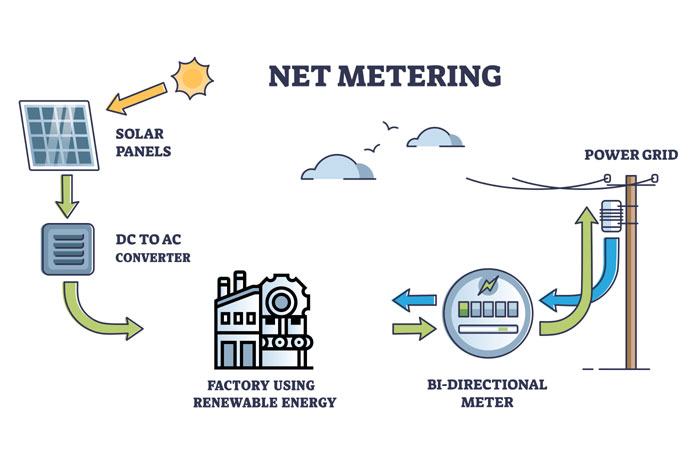

A brief idea about how it works from the below infographic.

Carbon offsetting is done to offset emissions elsewhere by reducing or eliminating emissions of carbon dioxide and other greenhouse gases. Offsets are measured in tons of carbon dioxide equivalent (CO2e). One tonne of carbon offset is equivalent to reducing or removing the equivalent of one tonne of carbon dioxide or other greenhouse gas. One of the hidden dangers of climate change policy is the unequal carbon price in the economy. The flow of production to regions and industries with lower carbon prices can cause economic collateral damage. Balancing compensation and price, unless CO2 can be purchased from the area.

Organizations and individuals pursue carbon offsets either voluntarily or to comply with regulations.

Individuals or companies can pay intermediaries to remove some of the carbon from the atmosphere in another part of the world. Clients calculate emission levels and brokers charge based on those levels. The broker then invests some of that money in projects that reduce carbon emissions.

For example, taking an aeroplane releases a certain amount of greenhouse gases into the atmosphere. That person uses a tool to calculate the emissions emitted on that flight and purchases carbon credits from a broker to offset that amount of emissions. The broker deducts the commission and invests the rest of the money in the issuing project. B. Reforestation measures.

Carbon credits cost between $3 and $5 per tonne of CO2 emissions.

An individual or organization receives a certificate or other evidence that they have purchased a carbon offset. You can then use this as proof that you have demonstrated compliance.

Another example is greenhouse gas emissions. Organisations can use tracking tools to monitor greenhouse gas emissions resulting from cloud usage, purchase carbon offsets, and comply with decarbonization standards.

An example of a regulation that encourages offset is the British Standards Institution's Publicly Available Specifications 2060. They detail how you can demonstrate CO2 neutrality and develop a CO2 management plan.

Organizations can take three steps to offset their carbon emissions:

Calculating Emissions.

There are special protocols that help companies do this. For example, the GHG Protocol is an internationally recognized accounting standard that helps organizations measure and manages their greenhouse gas emissions. The protocol divides emissions into three bands or ranges.

S 1 – are direct emissions from sources owned or controlled by the organization.

S 2 – are indirect emissions from electricity, steam, heating and cooling resources purchased by the organization.

S 3- is other indirect emissions from the organization's value chain.

Emissions are expressed in tons of carbon dioxide equivalent and include other greenhouse gases such as methane and nitrous oxide. Organizations should regularly assess their carbon footprint and include it in sustainability reports and other financial reports.

At least 40 countries require some form of emissions reporting. In the United States, companies that emit more than 25,000 tons of carbon dioxide are required to report their emissions to the EPA annually. The reporting threshold is lower in California at 10,000 tons.

Reduce emissions wherever possible. Once organizations measure their emissions and identify their sources, they can develop a sustainability strategy. Guidelines for reducing emissions can be found in the Science-Based Targets Initiative (SBTi) in line with the Paris Agreement targets. SBTi advises companies to use 80% renewable electricity by 2025.

Reduction in Emission.

Once organizations measure their emissions and identify their sources, they can develop a sustainability strategy. Guidelines for reducing emissions can be found in the Science-Based Targets Initiative (SBTi) in line with the Paris Agreement targets. SBTi advises companies to use 80% renewable electricity by 2025. CO2 reduction can be achieved by switching to a more sustainable diet or switching to more environmentally friendly modes of transportation, such as electric vehicles or trains with hybrid locomotives.

Compensate for Remaining Emissions.

Emissions that cannot be reduced can be offset. Reduction projects are projects that absorb or remove carbon dioxide. To issue a CO2 certificate, the project must be certified. Examples of international certifications:

Climate Action Reserve

Gold Standard

Plan Vivo

Once certified, third-party oversight organizations ensure projects meet standards such as

Positive Emission Removal.

Credits must represent reductions or reductions in emissions that otherwise would not have occurred. This requires the oversight body to ensure and confirm that the project uses validated methodologies and science in its calculations.

Leak-free.

The creation of a discharge certificate must not lead to discharge elsewhere. For example, if a project protects one forest, it will not increase deforestation in another unprotected area.

Permanent.

Credits represent emission reductions that cannot be reversed. For example, a project may aim to store carbon underground. The chances of this carbon returning to the atmosphere are slim.

Organizations must select Qualified Offset Projects that generate credits that meet these criteria. Additionally, projects should be selected that meet unique environmental and social criteria such as Supporting Biodiversity.

Post-purchase, organizations should be transparent with stakeholders about their offset strategy and the projects they support. Transparency is key to avoiding greenwashing allegations. Greenwashing is a marketing spin used to convince people that an organization's products, goals, and policies are environmentally friendly.

Forestry.

Afforestation projects restore areas threatened by deforestation. Wood absorbs and stores carbon. Without them, that carbon would be in the atmosphere, exacerbating global warming.

Agriculture.

Farmers use technology and techniques to grow crops to maximize resources and reduce waste when growing crops.

Aviation.

Airlines are using AI to optimize flight routes and minimize contrail formation.

These projects replace the use of fossil fuels with clean, renewable energy, such as that produced by wind farms.

Water Management.

The project can bring clean water to areas with polluted or polluted water, reducing the need to chemically treat or boil water.

Waste Management.

The project will recover landfill-generated methane from waste treatment.

Carbon Bond.

The project uses carbon capture and storage to dump carbon where it is unlikely to be released into the atmosphere. They take carbon from the air and store it in soil, wetlands, trees, and even rocks.

Energy Efficiency.

The project aims to improve the efficiency of existing infrastructure, including improving the insulation of buildings.

• Profitability: Investment in carbon credits is highly profitable and the market is projected to continue growing in the coming years.

• Environmental and Social Benefits: Carbon pricing provides incentives for companies to reduce their emissions. As emissions caps tighten and the price of carbon allowances rises, it will become more expensive for companies to pollute. By investing in carbon credits, investors can contribute to emission reduction strategies that benefit both people and the environment.

• Easy to Invest: Investing in ETFs is as easy as investing in any of his ETFs.

• Short Supply and Growing Demand: Currently, the supply of carbon credits is limited and business demand is high. Companies pre-purchase them to cover their emissions years in advance, increasing their value.

• Weak Correlation with Equity Markets: Carbon credits do not have a strong correlation with the rest of the equity market, which can be a good way to diversify a portfolio.

• Lowest Prices: Certain regions, such as Germany, are considering the lowest prices for CO2 certificates. That means their value can only rise from that price floor. California's carbon price floor is rising by 5% each year, and inflation is on the rise.

• Potential Risk: Certain Carbon Credit ETFs track futures in Carbon Credits, a volatile and risky asset. Also, since the carbon credit market is relatively new, historical data available for reference is limited.

• Narrow Exposure: Carbon markets are localized and still relatively small markets, so investing in them does not provide much portfolio diversification.

• Limited Environmental Impact: Cap-and-trade policies are intended to limit a company's emissions and reduce them over time, but they are also essentially pollution permits. In exchange for reducing emissions, companies can purchase more CO2 certificates. Therefore, the real environmental benefits of investing in allowances are limited.

• Not all carbon credits are created equal. Some carbon credits are better quality than others, and many factors determine their true value. It's important to buy through a reputable ETF or broker to make sure the credit is legitimate and worth it.

WAAREE RTL (WRTL) is Waaree Energies’ EPC arm which is also a listed company in India. It has an experience of more than 600MWp of Solar power plant installations across several countries including projects like ‘50MW in 100 Days – Vietnam’, while embarking on a successful competence in Ground mounted, Rooftop and Floating Solar power projects. WRTL has helped numerous clients with their transition to clean energy and helped reduce their carbon footprint with SOLAR POWER. Step on to your cleaner journey by contacting us at 18002121321 or mail us at waaree@waaree.com

Leave a Reply

You must be logged in to post a comment.